Maximizing Your Portfolio: Understanding and Achieving Risk-Adjusted Returns

Investing means linking returns with risk. Returns do not stand alone; they join with risk. Risk-adjusted returns help you see profit per unit of risk. This text shows what risk-adjusted returns are, how you can calculate them, and how you can use them to build a portfolio that fits your goals.

What Are Risk-Adjusted Returns?

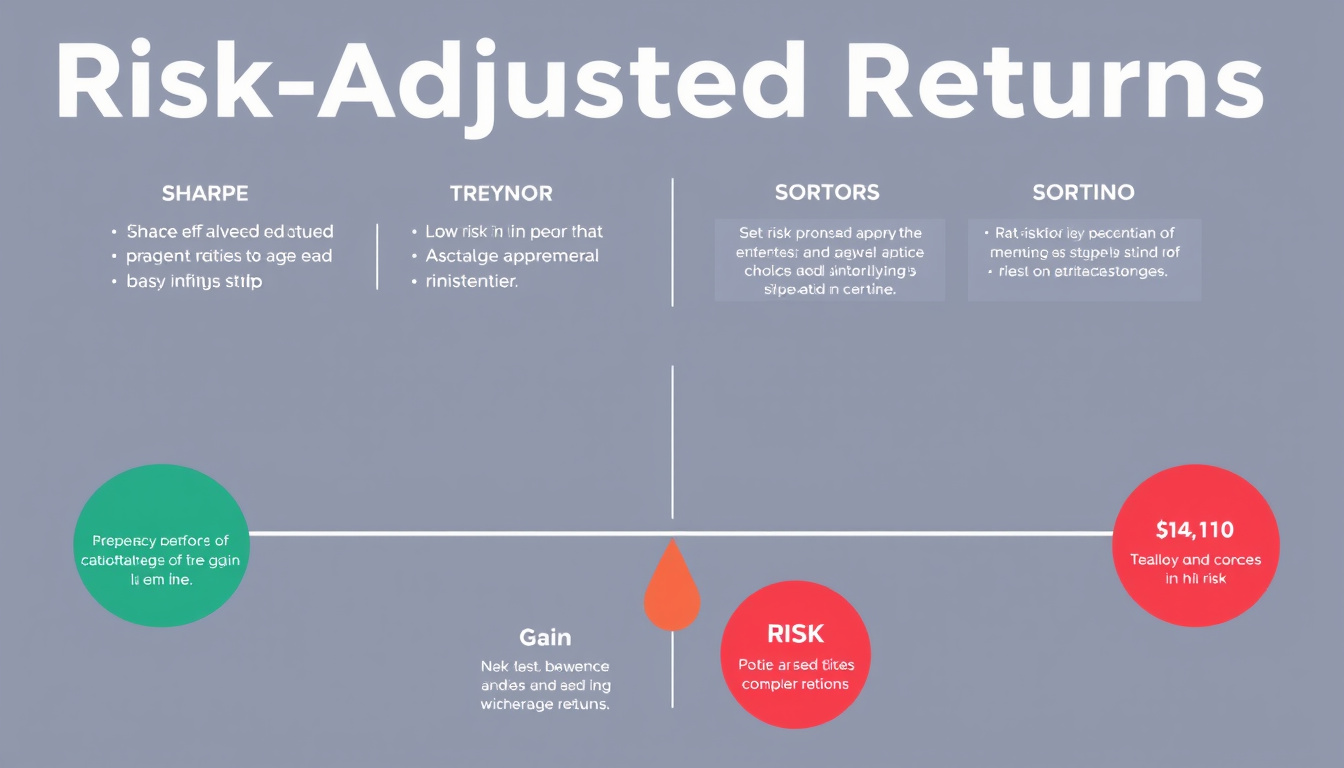

A risk-adjusted return is a measure that ties an investment’s return to its risk. Higher returns often come with higher risk. This measure helps you see if the reward is worth the risk. There are various ways to measure this value. The most common measures are:

- Sharpe Ratio

- Treynor Ratio

- Sortino Ratio

- Alpha

- Beta

1. The Sharpe Ratio

William F. Sharpe created this measure. It shows how much extra return you get for the risk you take. In short, you subtract a safe rate from the investment return. Then, you divide by the spread of returns (the standard deviation).

For example, if a fund earns 12%, its spread is 10%, and the safe rate is 3%, the Sharpe ratio becomes 0.9. This number tells you the return per unit of risk taken.

2. The Treynor Ratio

The Treynor ratio ties returns to market risk alone. It uses beta to measure market risk. A higher ratio means the return is high relative to market risk.

3. The Sortino Ratio

The Sortino ratio looks at the downside risk only. It does not mix good and bad spreads. In this way, it shows the return linked to negative swings from a set target.

4. Alpha

Alpha shows how much an investment beats a chosen standard. This measure sets aside market risk. When alpha is above zero, the investment outpaces its predicted return.

5. Beta

Beta compares the investment’s return changes to market moves. A beta above one means the investment changes more than the market does. This shows more risk compared to market trends.

How to Use Risk-Adjusted Returns in Portfolio Management

Using these measures lets you judge each investment against its risk. You can compare investments that do not share the same risk. This method builds a picture of how each asset fits with your risk level. It also helps you see if you get enough return for the risks you assume.

- You can compare returns across different investments.

- You can build a portfolio that fits your risk style.

- You can check how well each asset performs over time.

Special Considerations

Risk-adjusted measures are tools that use past data. Past trends do not fix future results. A short swing in the market may change the view. Hence, a long view is wise.

A focus on low risk does not always bring the best gain. In some trends, higher-risk choices may beat standard marks over long periods.

Conclusion

Risk-adjusted returns help you see return and risk as one pair. They let you connect each return with the risk taken. By using measures like the Sharpe, Treynor, and Sortino ratios, you can plan your path and adjust your portfolio to meet your needs. This way, you work toward a balance between gain and risk that fits your plans.